pay ohio unemployment taxes online

Files must be in the ICESA CSV or XML format. A convenience fee equal to 25 of your payment or 1 whichever is greater will be charged by ACI Payments Inc.

Ohio Payroll Services And Regulations Gusto

The Wheres My Refund tool can be accessed here.

. When you apply you will need. Please make a payment here or contact us at 888-301-8885. Web You can pay using a debit or credit card online by visiting ACI Payments Inc.

Any penalties and interest that accrue from missed tax payments will be your companys responsibility. Web To submit your quarterly tax report online please visit httpsthesourcejfsohiogov. You may apply for a waiver of these assessments.

If you filed an amended return you. The minimum Credit Card fee is 100. Web Taxes Benefits false Coronavirus and Unemployment Insurance Benefits.

There is a 400 transaction fee for Internet Checks or a 25 fee for Credit Cards. Mike DeWine Wednesday. Web COLUMBUS Ohioans who received unemployment benefits in 2020 wont have to pay income taxes on the first 10200 they received.

Web Make sure your employer number is shown on all copies being sent. Web Ohio Individual and School District Income Taxes Unpaid Balance July 19 2022 Starting August 9 2022 the Ohio Department of Taxation ODT will begin mailing non-remittance billing notices to taxpayers who have not paid in full their 2021 Ohio individual andor school district income tax liability reported on their returns. During the quick and simple registration process users create a User ID and password to use each time they access the online system.

If you are a new employer and need to set up your account you will need to start by registering your account. Unemployment Taxes ERIC Unemployment Benefits OJI Recruit and Hire Workers. Web Click here if you have paid wages under covered employment or if you have an existing agent account.

Web It is our aim to make payment as convenient as possible. File Unemployment Taxes Online. What information OnPay needs from you What state and local taxes and filings OnPay handles for Ohio employers.

Should you have any questions please call the contribution section at 614-466-2319. If you are an existing employer accessing The SOURCE for the first time you will need to authenticate your account. You may also use the Online Services portal to pay using a creditdebit card.

This payment method charges your credit card Discover Visa MasterCard or American Express. Or by calling 1-800-272-9829. Paper Form Exception Filing Information.

Web Ohio taxes unemployment benefits to the extent they are included in federal adjusted gross income AGI. Also used by employers to authorize the Ohio Department of. The SOURCE Upload File Employers and third party administrators can upload data directly in to The SOURCE.

Due to the Federal American Rescue Plan Act of 2021 signed into law on March 11 2021 the IRS is allowing certain taxpayers to deduct up to 10200 in unemployment benefits for tax year 2020. Employers who pay unemployment contributions. Web Accessibility Mode for Visually Impaired.

Web Payment can be made by credit or debit card Discover Visa MasterCard or American Express using the departments Online Services Guest Payment Service directly visiting ACI Payments Inc. Web The Employer Resource Information Center ERIC is a self-service unemployment compensation tax system that helps employers and third-party administrators get account numbers secure web access file quarterly reports make payments update their accounts and more. Apply for Unemployment Now Employee 1099 Employee Employer.

Web Welcome to the Ohio Unemployment SOURCE application. Web true Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19. To register and to learn about other online services visit Unemployment Tax Services.

Web Heres how to pay unemployment taxes for 2020 The first way to get clues about your refund is to try the IRS online tracker applications. Web Filing Your Weekly Claims. Employer Resource Hub If you are an Ohio employer who has completed or is planning a mass layoff or shutdown due to COVID-19 please review our key resource links and frequently asked questions to find out more about what.

JFS-20106 Employers Representative Authorization for Taxes. Web To file and pay online you can use either the ERIC system or the Ohio Business Gateway. Web Paying unemployment taxes online using Unemployment Tax Services requires registration.

Your Social Security number and drivers license or state ID number. Web You can apply for unemployment benefits online at the ODFJS website. You will be redirected to the ACI Payments Inc.

Web Please visit httpsthesourcejfsohiogov to enter your quarterly reports online. The name address phone number of your employer in the last six weeks. Unemployment Q.

Used by employers to authorize someone other than the employer to provide information pertaining to Unemployment Taxes. The change in a bill signed by Gov. Additional information about the Ohio Unemployment Tax can be obtained from our home page or by contacting the Division of Tax and Employer Service at 614 466-2319.

Doing so greatly reduces the possibility of errors and allows for faster more efficient processing. The dates you worked there and the reason you became unemployed from each job. Once the missing Quarterly Tax Return is processed you will be assessed penalty and interest.

Web Without this information OnPay will be unable to file or deposit any Ohio tax payments for your company.

More Ohioans Are Discovering They Ve Been Targeted By Unemployment Scammers Thanks To Unexpected Letters Cleveland Com

How To Claim Unemployment Benefits H R Block

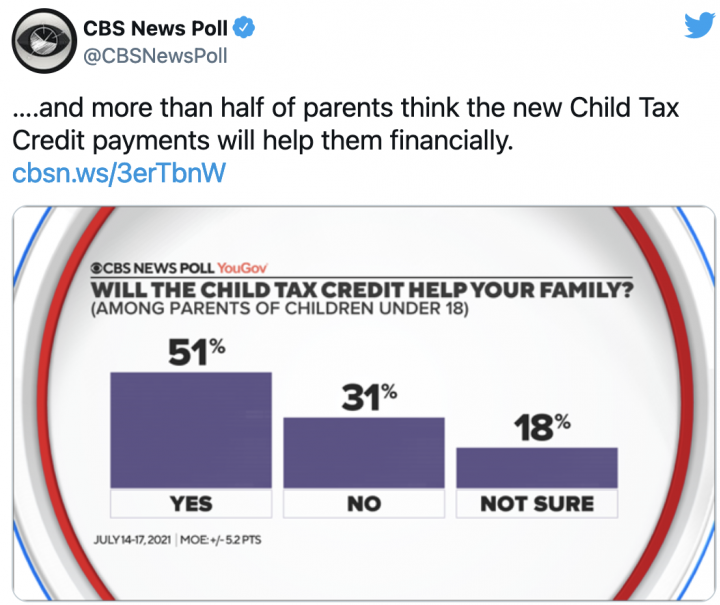

Fourth Stimulus Check And Child Tax Credit News Summary Monday 19 July As Usa

Do Large Corporate Tax Cuts Boost Wages Evidence From Ohio

Some People Not Receiving Unemployment 1099 G Tax Forms

Unemployment Tax Updates To Turbotax And H R Block

Five Things To Know For This Year S Tax Season Wane 15

Coronavirus Business Resources Ohio Chamber Of Commerceohio Chamber Of Commerce

Free Retainer Agreement Template Sample Pdf Word Eforms

Ohio Payroll Services And Regulations Gusto

North Carolina Unemployment How To Apply Credit Karma

How To File Taxes For Free In 2022 Money

Do Large Corporate Tax Cuts Boost Wages Evidence From Ohio

Ohio Paycheck Calculator Smartasset

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

How To Start A Nonprofit Organization 10 Step Guide Donorbox

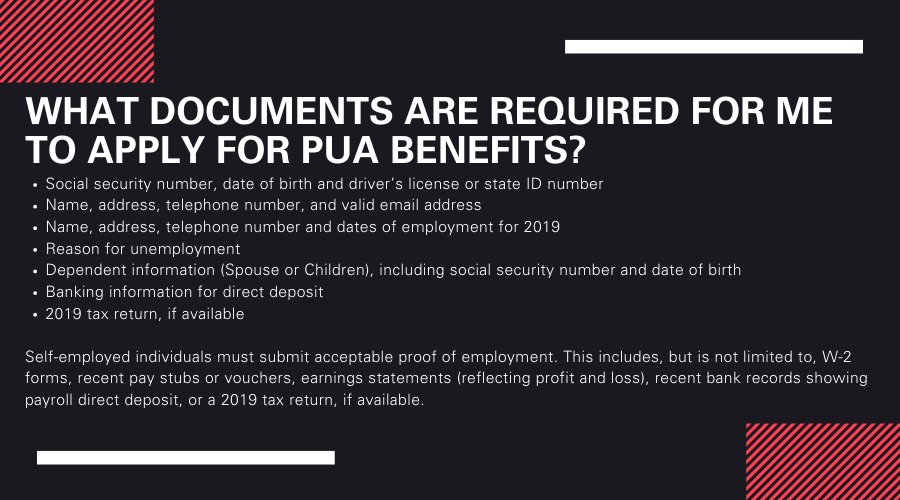

Ohiojfs On Twitter What Documents Are Required For Me To Apply For Pua Benefits For Answers To More Faq S Visit Https T Co Eummtiixu4 Inthistogetherohio Everyclaimisimportant Covid19 Https T Co Ab2yoopyfn Twitter